Redesigning user rejection

Credit card rejection was the most pressing problem Kiwi was facing as a business as

a poor application experience can frustrate users, hurt trust, and drive them away

Why redesign?

Credit card rejection was one of the most pressing problems Kiwi faced as a business.

A poor rejection experience didn’t just frustrate users, it hurt trust, led to social backlash, and directly affected retention metrics

On this initiative, I partnered with our APM and developers to reimagine how Kiwi communicates rejection, ensuring that even at the lowest point in a user journey, the brand felt empathetic, transparent, and trustworthy.

Research

We conducted both primary & secondary research to understand the pressing problems that users faced

Key user problems

When users applied for a credit card through Kiwi, a large portion were being rejected due to reasons beyond Kiwi’s control — such as banking partner policies, credit bureau issues, or mismatched details.

However, the experience they encountered amplified their frustration:

No clear explanation for rejection

User is frustrated even if they have good bureau report

Uncertainty about when (or if) they could reapply

Filling wrong information in application form

Fear of data misuse by third parties

Anxiety about whether their credit score was impacted

Business problems

Brand Impact

As a result of rejection the users is frustrated which leads to them going out on social media or playstore affecting ratings and overall image of the company.

User retention

As a result of rejection users who can use Kiwi for UPI, were also dropping of as they didn’t feel the need to stay as they got rejected

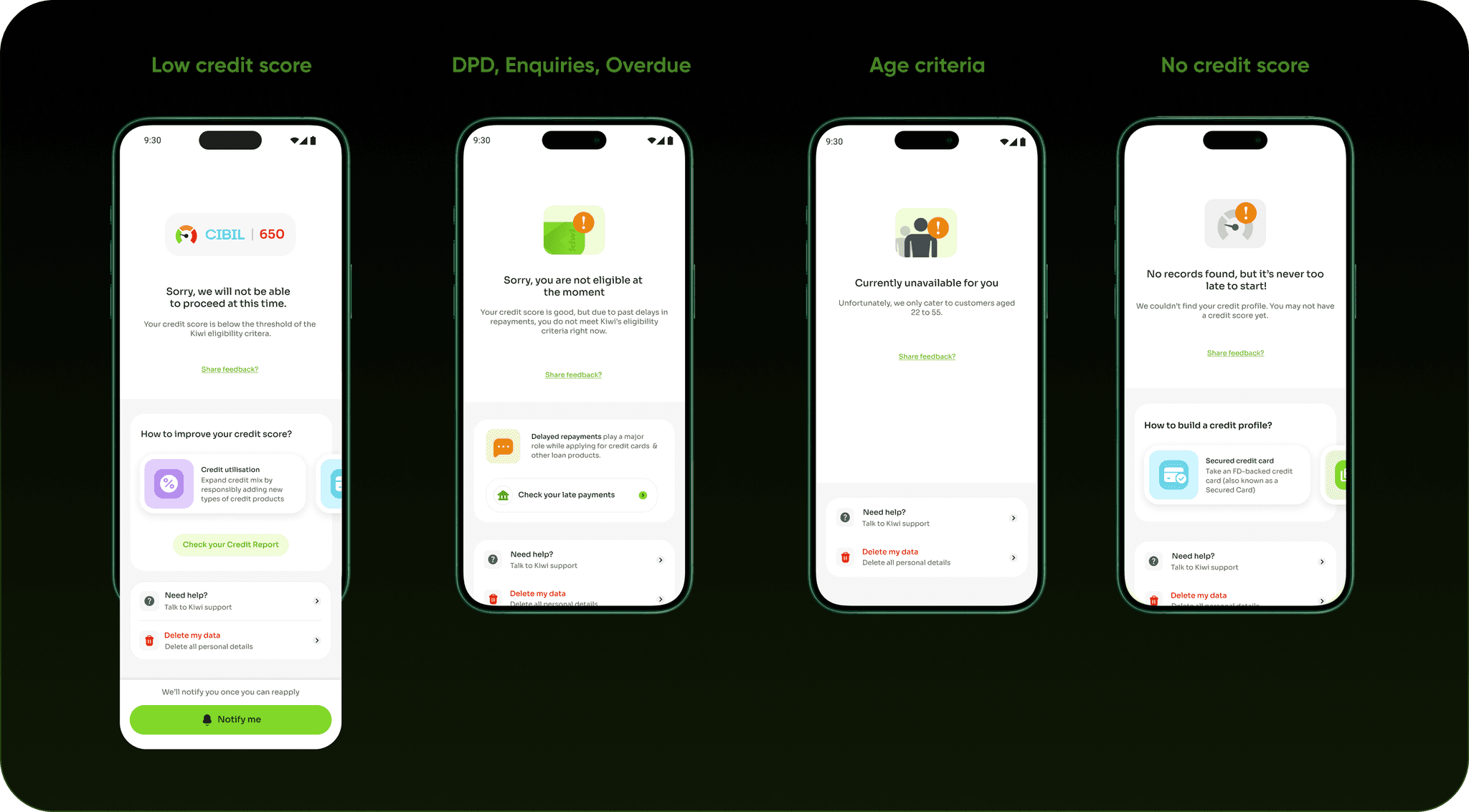

Reasons for getting rejected

User can get rejected due to multiple reasons, some of them are mentioned below

& many more....

Existing solution

The existing solution provided a lot of challenges like

Visuals (like a falling house of cards) reinforced failure.

No clear next step or explanation

Not giving users proper reasoning as to why they were rejected

Unclear whether users could still use Kiwi.

Stages where rejection can happen

Strategy

👉

We first focused on “Visibility” & “User retention” as these were the pressing problem at that moment

Visibility & retention

This mainly led us to think around these things & then only work on the initial wireframing

How to ease user frustration right after they get rejected

What kind of user to retain? (Mainly focused to retain good bureau users)

Final solution

Solution for some other rejection cases

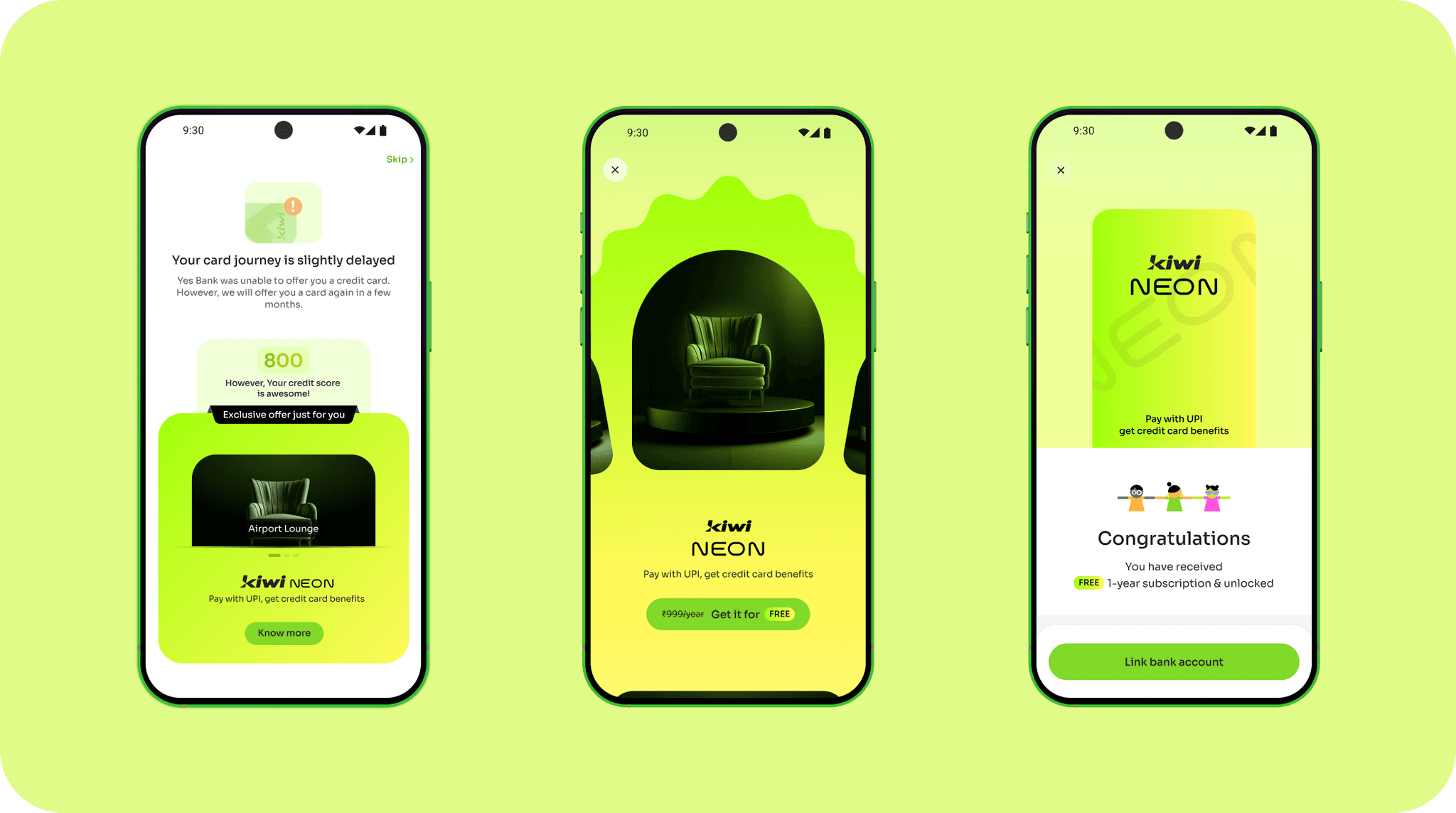

Users with good score but still rejected

These users needed extra care as these were the users who were the most frustrated

They are the users who are important to retain as they will are most likely to get the credit card next if we onboard new banks

Impact

Almost zero review related to the above mentioned problems

Retaining 8% of the rejected users with W1 retention of 45%

Increased play store ratings by 0.2 (indirect correlation)